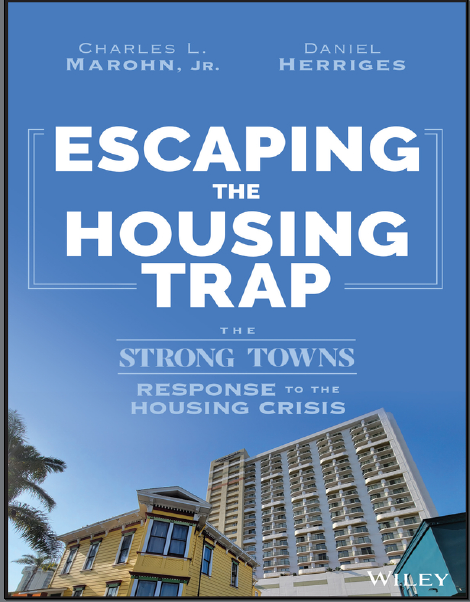

This new book by Strong Towns head Chuck Marohn (and Daniel Herriges) is worthwhile for anyone who wants to understand where America’s “housing crisis” came from. The history is important: How did we get here? He goes thru how housing was financed a hundred years ago, federal programs enacted in response to the 1929++ economic depression and subsequent disruptions, subsequent federal programs, and the dilemma we have today.

This new book by Strong Towns head Chuck Marohn (and Daniel Herriges) is worthwhile for anyone who wants to understand where America’s “housing crisis” came from. The history is important: How did we get here? He goes thru how housing was financed a hundred years ago, federal programs enacted in response to the 1929++ economic depression and subsequent disruptions, subsequent federal programs, and the dilemma we have today.

About 2/3 of American households are homeowners, they have (or hope to obtain) “equity” in their property, and they really don’t want to see the economic value of their holdings decline. Many of them are already stressed by the cost of paying their mortgages, taxes, maintenance expenses, and other costs of living. Not to mention the cost of owning and operating automobiles, as in most communities life without one is quite inconvenient.

The remaining third are renters (plus the unhoused). Many of them are also under economic pressure, as rents in recent decades have outpaced incomes. They might like to see housing prices decline, or more precisely to see the housing they want become easier for them to afford.

So there are big interests who want housing costs to decline, and who don’t want the price of housing to decline.

Part of the problem, as Marohn sees it, is that nowadays housing is built, financed, and often managed at a national scale. These folks are professionals who can deal with complex zoning and building code requirements. So part of the remedy is for local governments to make it easier for small-scale, local builders to make housing. This would include allowing an increase in density by right, such as backyard cottages, accessory apartments, or a two or three unit building in areas which have been restricted to single family.

This isn’t wrong, and I have enough personal experience dealing with building and zoning officials in a “progressive” community to know that improvements would be helpful. Even Brandon Johnson claims to be aware of the problem.

Working thru the book, I kept wondering what happened to the land value tax, which I know Marohn has supported. When I got to the example on “Financing Backyard Cottages” where he notes that one advantage would be additional property tax revenue, it sure looked like LVT has been tossed aside. Finally, toward the end of the penultimate chapter, he says “the land value tax… is perhaps the best mechanism to overcome neighborhood stagnation and decline.” Well it was nice he was able to fit this in.

I do recommend this book to anyone interested in realistic ways to get more housing built, or just in finding out how we got where we are. However, if you want to know how the whole problem could have been avoided by getting public revenue primarily from the value of land and other privileges, you’ll want to look elsewhere.