I am in no way qualified to review works of acknowledged fiction, as I read very few. But I have been intrigued by David Foster Wallace since a Radio National commentator observed that Wallace had, in his 1996 novel Infinite Jest, anticipated the effect of the Internet. When later I learned that his final, unfinished work, which had been assembled by his longtime editor, was about the administration of the U S Federal income tax, I couldn’t resist taking a look at it. I thought it might give some insight into how the IRS staff manage to actually patch together the mess of U S tax law and regulations to maintain something which provides the rulers with pretty good control as well as huge revenue, without causing any effective revolt by taxpayers.

No success there, I’m afraid, which is all the more disappointing because, in Chapter 9 Wallace breaks into whatever narrative structure the book has to say that, hey, here I am, a real person, and this book portrays real people and events modified only slightly. Then he points out that on the copyright page is the statement that “The characters and events in this book are fictitious. Any similarity to real persons, living or dead, is coincidental and not intended by the author,” which assertion necessarily applies to his statement that the book is not fiction.

Beyond that, the work is set in the 1980s, when the tax rules were simpler, with documentation and computerization far less than today. Which meant that a lot of people spent their days manually comparing sets of figures, on return after return, hour after hour, day after day. I suspect that in today’s IRS much of this work has been computerized, with the human staff devoting their time to other things perhaps too horrible to contemplate.

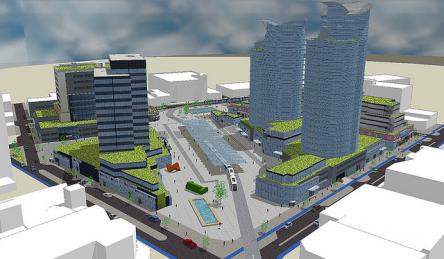

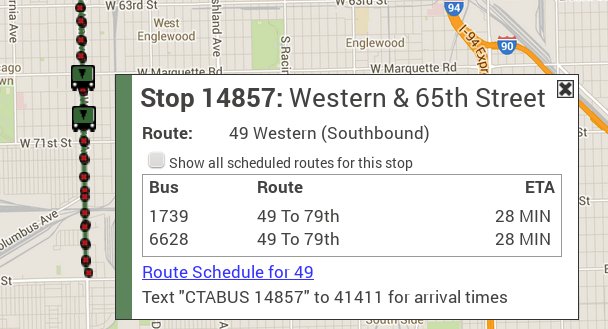

Too, a lot of the book is just contrary to fact. The description of the Chicago public transportation system, to take one aspect of interest, is simply wrong. CTA do not operate any high-speed commuter trains, nor did they ever have a station named “Washington Square.” And it would be virtually impossible today for a passenger, with his arm stuck in the door of a crowded train, to be dragged along the platform to his death, because every railcar has long had a red handle, at every door, which any passenger could pull to open the door and stop the train (here’s why).

That said, there are some helpful insights about how the regime makes use of dullness:

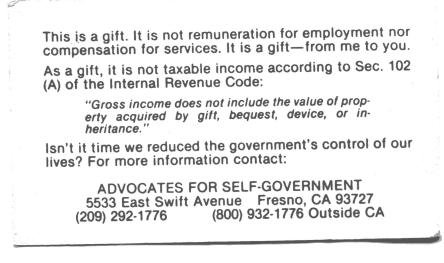

[T]he whole subject of tax policy and administration is dull. Massively, spectacularly dull. It is impossible to overstate the importance of this feature. Consider, from the [Internal Revenue] Service’s perspective, the advantages of the dull, the arcane, the mind-numbingly complex. The IRS was one of the first government agencies to learn that such qualities help insulate them against public protest and political opposition, and that abstruse dullness is actually a much more effective shield than is secrecy. For the great disadvantage of secrecy is that it’s interesting (from page 83 in chapter 9)

And the key to success in a bureaucracy:

The underlying bureaucratic key is the ability to deal with boredom. To function effectively in an environment that precludes everything vital and human. To breathe, so to speak, without air.

The key is the ability, whether innate or conditioned, to find the other side of the rote, the picayune, the meaningless, the repetitive, the pointlessly complex. To be, in a word, unborable…

It is the key to modern life. If you are immune to boredom, there is literally nothing you cannot accomplish. (pp 437-438 in chapter 44)

No, they aren’t all one and the same.

No, they aren’t all one and the same.