An informed review by political economist Ed Dodson of Tim Howard’s new book about the collapse of Fannie Mae. The senior people understood that they were in trouble due to politics and ideology, and they saw the collapse of underwriting standards, but most had no interest in addressing the fundamental cause.

Category: land value

Misunderstanding housing costs again

Melissa Kite had a piece in Thursday’s Guardian complaining about the escalating cost of London housing. She starts off well, observing that she can’t earn as much in a year as the increase in the value of her flat. “[W]hat does it say about our society when we can, in theory at least, make more money doing nothing than we can by the sweat of our brow?” Agreed, it’s a problem. So what does she recommend?

In New York, 45% of people live in rent-stabilised accommodation where landlords are limited to increasing rates by a certain percentage each year. This is not rent control – which accounts for only 1% of tenants – but rent with controlled increases, an important difference.

I will wait to hear from New Yorkers about how this has solved their housing problem. Going back to the Guardian article, Kite gets pretty close when she observes that “a British company is selling a flat-pack self-assembly ‘house in a box.’ But she doesn’t take the next step to ask: “If you buy one, where are you going to place it?” The answer, of course, will be that anyone who can afford only the flat-pack house will be unable to obtain a suitable site anywhere near London.

The problem isn’t house costs, it’s land costs. And land costs would be a lot lower if all land was subject to a stiff site value tax, because there could be little or no speculative premium. (To be clear, the cost of obtaining a site for your house, purchase financing plus tax, would be much less if landholders weren’t pricing sites based on their future hopes rather than current usefulness.) This point is readily made, for example here and here. It’s unfortunate that the writer of the Guardian article seems unfamiliar with the concept.

NY Times reports another benefit of the citizens dividend

If the earth belongs to the people, then whatever is paid for the use thereof belongs to them in some equitable fashion also. Therefore, beyond what’s needed for legitimate government purposes, there would seem to be enough for a considerable “citizen’s dividend” for everyone. Plenty of discussion on this subject can be found here.

My guess is that it would likely be enough to replace most of the aid programs which provide funds — rarely enough but maybe better than nothing — to low income people. One advantage is that it could be administered at relatively modest expense. A related advantage is that it can probably be made to work, with everyone getting what they’re entitled to. This latter aspect is what came to mind when I read this NY Times article, in which a Georgetown law professor summarizes “a litany of automation and contracting meltdowns” whereby the poor were unable to obtain benefits to which they were entitled under various aid programs and which may have been essential to their support.

His point seems to be that, while healthcare.gov suffered major problems initially, it was soon repaired because its failure affected many non-poor people. (I have no idea how well-repaired it might be, but will assume he is correct about this.) He does not mention the citizens dividend, perhaps is unaware of it, or maybe ignores it because it would likely reduce the demand for lawyers. But he makes the case. A regular check for everyone, as a just entitlement, would be a far simpler system than most of the means-tested (and otherwise-restricted) aid programs which cost taxpayers so much money.

And while we’re on the subject of means-tested programs, consider this:

[I]f a single mother has two children in childcare and she’s making $36,000, she’ll pay about $310 a month for childcare. Then, if she gets a raise to $37,000, she’ll need to pay $1,200 a month for childcare because of the loss of a subsidy.

Of course, it needn’t be a raise, it might just be a decision to work a bit of overtime. I have written about this before and I will probably have to write about it again. Means-tested aid is a disgrace.

Progressive proposal from Kenya

Writing in Standard Digital, Charles Kanjama proposes that “If government was clever, it would include a value-capture approach in project financing.” He’s writing about big infrastructure projects, which in his time (2014) and place (Kenya) include railway and port improvements. He suggests that perhaps half the cost should come from land value tax, without explaining why it would be appropriate for landowners to receive half the benefit of improvements paid for by the general community. (Kanjama is an attorney and accountant who was rated among the top 100 legal minds in Kenya as well as one of the 100 most influential people in that country.)

The same edition (January 4 2014) carries another article showing a problem resulting from failure of the community to collect all the rent. It seems that the government wanted to remove a large number of squatters who had settled in a protected forest. Ordered to vacate, they each received 400,000 shillings ($4604.67 US, according to Wolfram Alpha) to purchase land elsewhere. Now the time for relocation has expired, and many spent the money on things other than land. Of course I don’t know these people, don’t know what land was available, don’t know their needs, but very clearly if land were nearly free (as results from a high land value tax) they would almost certainly be better off.

What cell towers might be worth

I just happened on this article from Reuters (via Yahoo), reporting that AT&T has long-tem leased or sold 9700 cell towers for what appears to be $500,000 each, including a leaseback of each at $1900/month with 2% annual escalation. Lots of details aren’t included, but it gives some idea of what an old water tower or other (possibly disused) elevated location in an urban area can be worth. Curious why there don’t appear to be any antennas on the downtown Chicago tower pictured here; perhaps they’re on the other side.

Land value depends on the definition

In an urban context, absent special environmental issues or legal constraints, land value and location value are pretty much the same thing. So we read in Crains that the Drake Hotel is on a 63,000 square foot parcel valued at $150 million, implying this land is worth about $2381/square foot. But no, the location probably isn’t worth that much. Rather, the land is leased by the owner of the structure, and the lease document says that, every five years, the land value is to be estimated and the annual rental set at 10% of the land value.

Possibly 10% was a reasonable return in the past, but in today’s zero-interest-rate world no safe investment would yield that much. Rather, the owner of the land actually owns two things: (1) the land, and (2) the privilege of requiring the building owner to pay an above-market rental rate. Were we to value the land “as vacant,” which is the correct way to estimate land value for taxation purposes, then (2) would disappear and the land would be worth, more or less, the same per square foot as other land in the very prestigious immediate neighborhood.

It would be interesting to see what the lease says specifically about how the land value is to be estimated, and to read the (certainly confidential) document describing how the $150 million value is justified.

For more discussion about methods of valuing land for assessment purposes, duck around for works by Ted Gwartney on the subject, or consult the old but still-relevant TRED volume.

Location remains critical, even as the criteria change

The Internet doesn’t make the earth economically flat. Some locations are still worth many times as much as others. But technology can affect the criteria for “most valuable site,” as most recently illustrated by the sale of One Wilshire Blvd in Los Angeles for more than twice the price per square foot of a mostly similar office building nearby. It also commands about twice the rent, per square foot.

The difference: One Wilshire is ” the primary terminus for major fiber-optic cable routes between Asia and North America,” and is therefore is a location prized by telecommunications firms.

“You can’t reproduce the connectivity,” said real estate broker Kevin Shannon of CBRE Group Inc. “It’s telecom gold.”

Of course the buyer thinks it’s a fine investment that will only become more valuable in the future. Presumably the seller thinks different. The only thing certain is that technology will change, and the pattern of valuable sites will likely be affected.

Aussie prof says land value increase can fund light rail

Land value increase due to light rail is sufficient to pay the entire cost of construction, asserts Curtin U. Prof Peter Newman. At a minimum, he suggests, the increased real estate tax revenue resulting from the system should be used as part of the funding. This from an interview on (Australia) Radio National‘s Saturday Extra, May 18. I think RN leave their audio posted for only a few weeks after broadcast. One assumes Newman has written some posts somewhere documenting his assertions, but a quick search doesn’t reveal any.

Fighting nature with sheep

The problem, according to Science Daily, is that marginal pastureland in the Swiss Alps, after 8 centuries, is being abandoned and given back to nature. So what does nature do? She grows green alder, which by increasing evaporated water causes a decrease in runoff feeding streams. These streams feed hydroelectric generators, and thus the reduced flow, in one valley alone, will cost something like 500,000 to 1,000,000 Swiss francs annually. The alder also “contaminates the water with nitrates,” tho the article doesn’t explain how this is a problem.

The remedy? Researchers demonstrated that Engadine sheep will peel the bark off the alder, killing them and [presumably] restoring grassland. But “the added financial value of sustainable land use is not sufficient to keep the arable land open.”

Which raises the interesting question: Which poor country has a sheep-raising tradition and potential emigrants who might like to move to Switzerland?

Another report ignores the citizens dividend

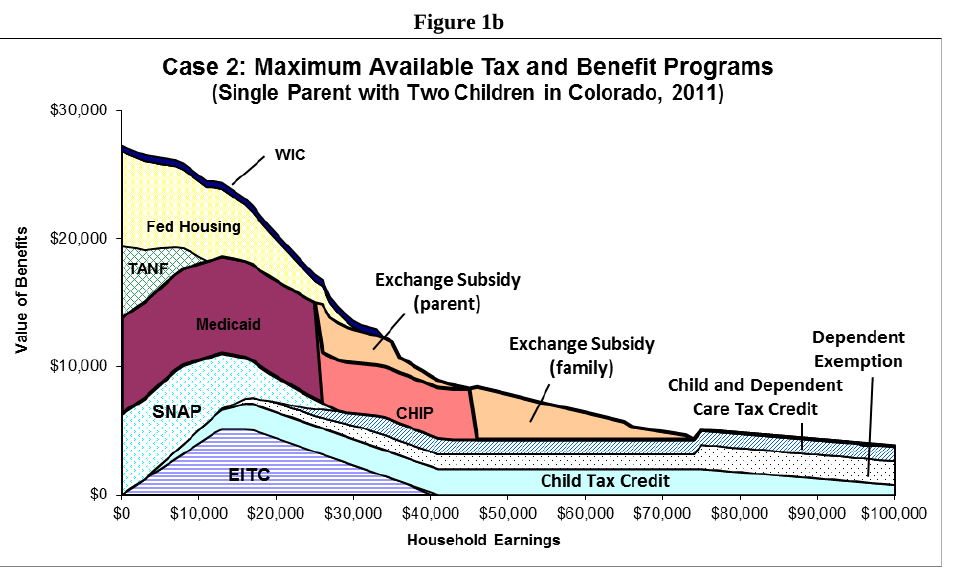

I’ve written before about the wild effects of graduated taxes and means-tested benefits which can dump low-income workers into effective tax brackets in excess of 100%. That is, once the effects on eligibility for earned income tax credit, child tax credit, medicaid, SNAP (food stamps), subsidized housing, and so forth are taken into account, an extra $1000 of income can easily cost more than that amount in increased taxes plus reduced benefits. (Worse, most low-income people don’t have professional accountants who keep track of this, and so they don’t know in advance what the effects of getting a raise, or taking some overtime, might be.)

This is hardly original with me, and most recently the Congressional Budget Office has issued a report on the subject, summarized here by Evan Soltas of Bloomberg. What can be done to fix this? Not much, conclude most writers including Soltas. We need tax revenue, we need to target aid to those with the greatest need, we can’t expect the rich to pay everything (since they have the lobbyists, lawyers and accountants to limit the taxes they pay.)

None of the writers who get attention seem to consider the citizens dividend. The basic idea is that government collects all the land rent — that is, the effective rental value of private control of natural resources — and share it with all citizens, everyone getting an equal share. It’s done on a small scale in several jurisdictions, including Alaska where each state resident gets a thousand dollars or so, each year, as a share of investments funded by mineral resources. Of course, natural resources include not only oil, gas, and ore, but also the electromagnetic spectrum, agricultural land, forests, and much of the value of land sites (except of course those which have no market value.) Suppose this rental value, or just a substantial part of it, were collected by the federal government and distributed, equally, to every U S citizen (maybe legal permanent residents should get a share also). How much would that be? Would it be enough to pretty much replace most means-tested programs? Wouldn’t that solve our problem?

Of course, arguments for collecting economic rent go far beyond fixing the screwed-up incentives of means-tested programs and graduated income taxes, (visit a Henry George School or the Henry George Institute to learn more), but let’s not forget this benefit.

And by the way, it isn’t only the poor who can face these >100% marginal rates. I wrote before about how certain Cook County homeowners with incomes in the $75,000 – $100,000 could face such rates; I don’t know whether these limits remain in effect. More broadly, it seems that affluent Americans subject to Medicare face a similar situation: As explained here, should your “modified adjusted gross income” amount to $107,001, then your Medicare cost will be $754.80 more than if your income had been only $107,000. The effective tax rate on that particular dollar is 75,480%. (Of course if you have a really alert accountant keeping track of all your financial affairs, she will alert you and find a way to avoid that extra dollar. And that accountant knows that the rates quoted above are for 2011 income, at least I think they are, and different limits will be in effect for the current year.)