As Tolstoy pointed out in slightly different words, anyone who understands the fundamentals of public finance cannot fail to agree that the smartest way to fund our governments is to collect economic rent. So the challenge for Georgists is simply to get the 99% of the population who really don’t think about these things to do so.

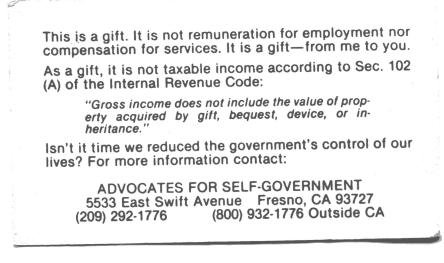

Which brings to mind some cards printed many many years ago by Advocates for Self Government.

The idea is, of course, that if you like (or respect or admire) the person who served you, you don’t tip, but give a gift. A gift to an individual is taxable to the giver, not the recipient, but as long as you don’t give any one person more than $14,000 you won’t pay gift tax. (I get my information from Wikipedia, which is no more likely to be incorrect than other sources I know of.) I find tipping disconcerting, but I do admire and respect the ability of many baristas, waiters, cabdrivers, barbers, etc who have skills I could never hope to develop. I like some of them too, and have had a few of them as students learning the fundamentals of political economy.

So this is an approach Georgists might try, to encourage more folks to think about important issues, while making their lives just a teeny bit easier. No, I have no idea what happens if you put a card and a small amount of money in a tip jar. Maybe new regulations will be issued requiring separate gift jars, and auditors dispatched to assure compliance..

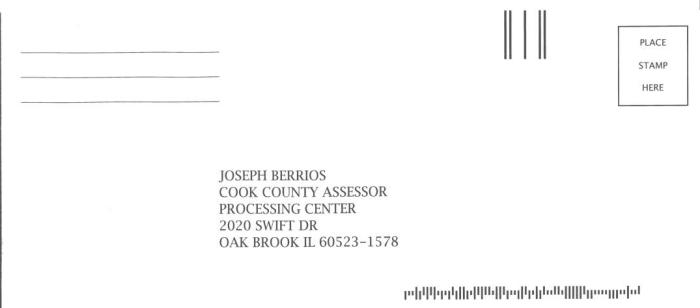

When the dinky suburb I live in decided to outsource the water bill processing to a firm six towns distant, I didn’t really object. Maybe it’s more efficient to have the work done elsewhere. But when the Cook County Assessor asked me to send a form to an address just outside the county boundary, I wonder what message he is trying to send.

When the dinky suburb I live in decided to outsource the water bill processing to a firm six towns distant, I didn’t really object. Maybe it’s more efficient to have the work done elsewhere. But when the Cook County Assessor asked me to send a form to an address just outside the county boundary, I wonder what message he is trying to send.