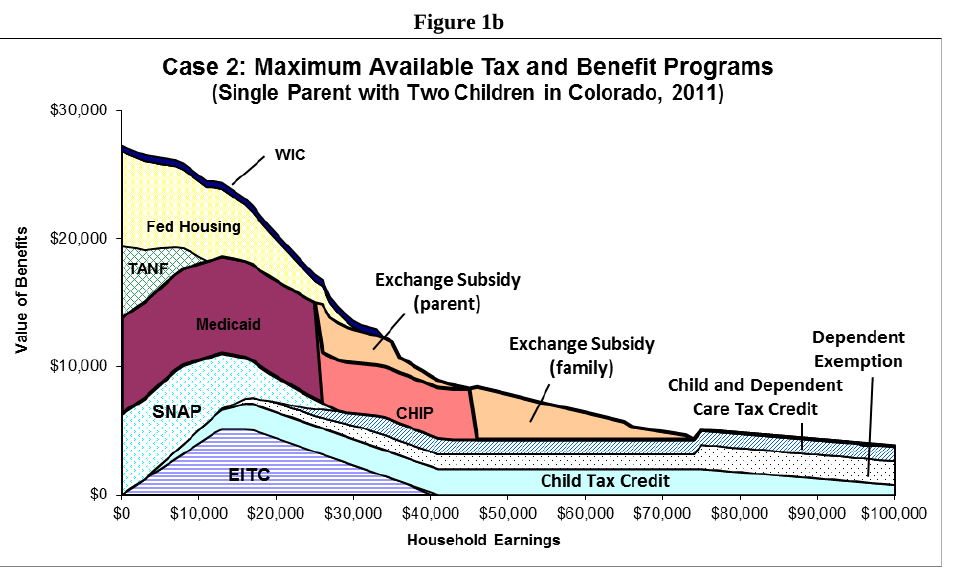

I’ve written before about the wild effects of graduated taxes and means-tested benefits which can dump low-income workers into effective tax brackets in excess of 100%. That is, once the effects on eligibility for earned income tax credit, child tax credit, medicaid, SNAP (food stamps), subsidized housing, and so forth are taken into account, an extra $1000 of income can easily cost more than that amount in increased taxes plus reduced benefits. (Worse, most low-income people don’t have professional accountants who keep track of this, and so they don’t know in advance what the effects of getting a raise, or taking some overtime, might be.)

This is hardly original with me, and most recently the Congressional Budget Office has issued a report on the subject, summarized here by Evan Soltas of Bloomberg. What can be done to fix this? Not much, conclude most writers including Soltas. We need tax revenue, we need to target aid to those with the greatest need, we can’t expect the rich to pay everything (since they have the lobbyists, lawyers and accountants to limit the taxes they pay.)

None of the writers who get attention seem to consider the citizens dividend. The basic idea is that government collects all the land rent — that is, the effective rental value of private control of natural resources — and share it with all citizens, everyone getting an equal share. It’s done on a small scale in several jurisdictions, including Alaska where each state resident gets a thousand dollars or so, each year, as a share of investments funded by mineral resources. Of course, natural resources include not only oil, gas, and ore, but also the electromagnetic spectrum, agricultural land, forests, and much of the value of land sites (except of course those which have no market value.) Suppose this rental value, or just a substantial part of it, were collected by the federal government and distributed, equally, to every U S citizen (maybe legal permanent residents should get a share also). How much would that be? Would it be enough to pretty much replace most means-tested programs? Wouldn’t that solve our problem?

Of course, arguments for collecting economic rent go far beyond fixing the screwed-up incentives of means-tested programs and graduated income taxes, (visit a Henry George School or the Henry George Institute to learn more), but let’s not forget this benefit.

And by the way, it isn’t only the poor who can face these >100% marginal rates. I wrote before about how certain Cook County homeowners with incomes in the $75,000 – $100,000 could face such rates; I don’t know whether these limits remain in effect. More broadly, it seems that affluent Americans subject to Medicare face a similar situation: As explained here, should your “modified adjusted gross income” amount to $107,001, then your Medicare cost will be $754.80 more than if your income had been only $107,000. The effective tax rate on that particular dollar is 75,480%. (Of course if you have a really alert accountant keeping track of all your financial affairs, she will alert you and find a way to avoid that extra dollar. And that accountant knows that the rates quoted above are for 2011 income, at least I think they are, and different limits will be in effect for the current year.)