We have a new report(pdf) today from the Civic Consulting Alliance, pointing out that residential assessments (excluding condominiums and large apartment buildings) done by Joe Berrios and his crew are of poor technical quality, don’t make effective use of modern techniques, and tend to treat expensive properties more leniently than less expensive ones. The Tribune article gives pretty good context and describes the contents of the report, so I won’t try to duplicate it. Rather, I’ll focus on just a few things that caught my eye.

The study uses data that apparently has never been made public. That is, it belongs to the public as represented by Joe Berrios, but the public hasn’t been permitted to see it. And we’re still not permitted to see it. In fact, the consultants and the Assessor seem to have spent more than two months negotiating a five-page nondisclosure agreement (reproduced at the end of the report) to make sure we wouldn’t see it. But we are able to see some detailed analysis, in the study appendix, that’s more useful than the raw data for understanding how assessments actually work.

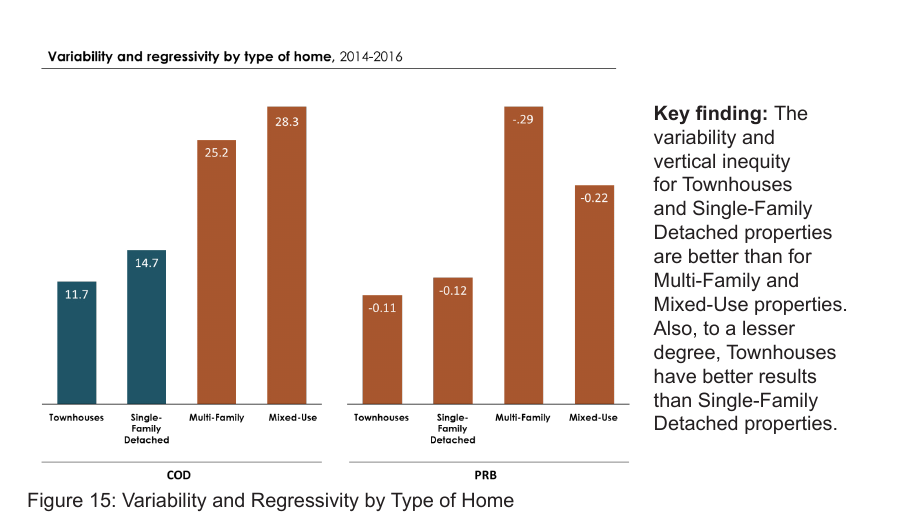

We get some useful detail on the bias in favor of expensive properties.

The above figure, which is Appendix Table 5 in the report, shows the inaccuracy (left half, shorter bar means less inaccurate) and bias in favor of expensive properties (right half, shorter bar means less bias). We can see that the bias in favor of expensive properties exists for all four categories, but is most serious for multi-family and mixed-use (residential with a storefront, for example). But for such properties, there’s no reason to expect that the expensive property contains the wealthier taxpayer.

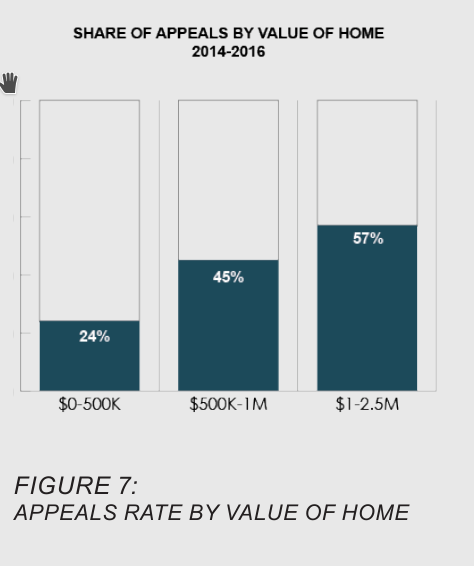

Also as previously observed, the report notes that more appeals are filed by owners of more expensive properties:

This implies that wealthier homeowners are getting a bigger tax break, proportionally, than less wealthy homeowners. I suspect it’s true, but I really don’t see any way around it within the current assessment system. The wealthier homeowner has more to gain from a successful appeal (or, what is the same thing, more to lose by failing to appeal.) She may also be more comfortable dealing with government officials and forms (and perhaps with the tax lawyers who send mailings to homeowners).

But isn’t the same true of the income tax? The wealthier taxpayer is more likely to know, or learn, tax-avoidance tricks, and/or to use a skilled tax preparer. The difference is that parcel-level assessment data is, to some extent, public information, but income tax returns in the U S no longer are.

Of course the main remedy for problems of inequitable assessments comprises:

(1) Assess only land value, ignoring the value of any improvements on the parcel.

(2) Post the assessments, including all information used to calculate them.

When the dinky suburb I live in decided to outsource the water bill processing to a firm six towns distant, I didn’t really object. Maybe it’s more efficient to have the work done elsewhere. But when the Cook County Assessor asked me to send a form to an address just outside the county boundary, I wonder what message he is trying to send.

When the dinky suburb I live in decided to outsource the water bill processing to a firm six towns distant, I didn’t really object. Maybe it’s more efficient to have the work done elsewhere. But when the Cook County Assessor asked me to send a form to an address just outside the county boundary, I wonder what message he is trying to send.