I don’t know that governments are always and inevitably corrupt, but there sure seems to be a lot of corruption going on. It isn’t a new development; maybe it’s worse nowadays or maybe just more visible.

So how can we single taxers say that we want the government to collect all, or nearly all, of the economic rent? Don’t we know that it will be stolen or, at best, wasted?

Not necessarily. Consider the following:

In the U S at least, real estate tax is administered and collected at the local — that is, substate– level. This is where the records and expertise needed to operate a land value tax exist.

Unlike income tax or sales tax, nearly all the data involved in real estate taxation is public information. Most of this data is accessible to everyone with internet access, generally without fee. I can see how much real estate tax my neighbor paid. I cannot see how much income tax they paid. The same goes for sales taxes and most other kinds of taxes. So cheating in real estate tax can be seen. That doesn’t mean it will always be impossible for people to cheat, but it provides a much greater possibility that cheating will be observed and rectified.

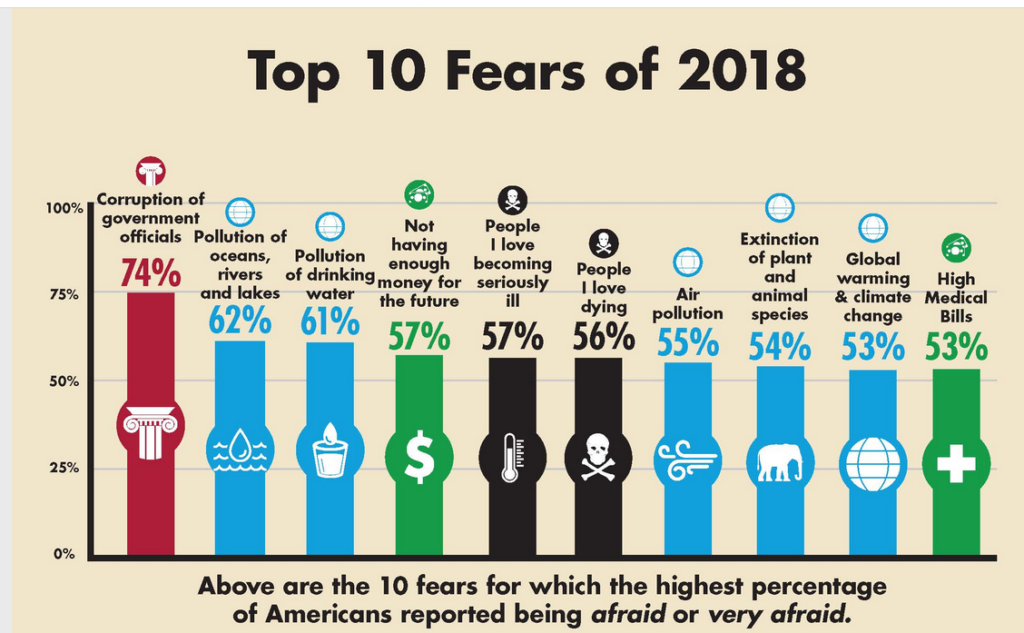

Government corruption seems to be a function of government size. A survey earlier this year found that “87% of voters nationwide believe corruption is widespread in the federal government. Solid majorities believe there is also corruption in state (70%) and local (57%) government.” Looked at the other way round, only 13% of us believe the federal government is possibly honest, compared to 30% for states and 43% for localities. I actually believe that one of the local governments to whom I pay taxes is pretty honest and efficient.

State and federal governments might logically collect some of the economic rent. Examples currently include severance taxes and could reasonably include rents for electromagnetic spectrum should our rulers become persuaded to levy and collect them. Existing federal agencies are able to review and evaluate collection efforts.