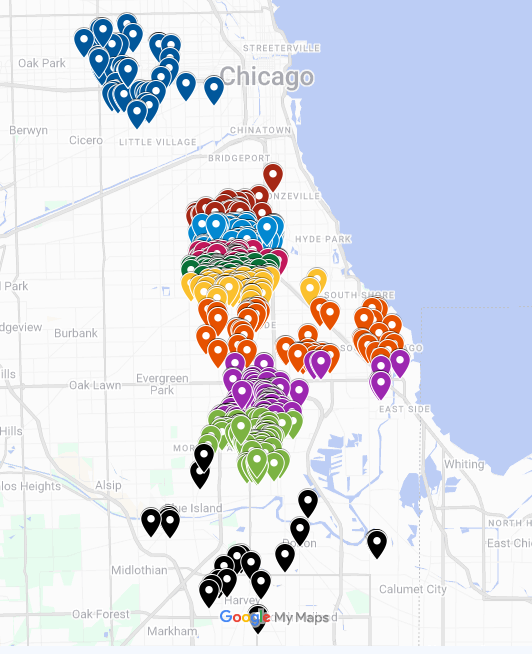

Tribune reports (via yahoo news, alternative link) that a portfolio of 812 lots, nearly all in Chicago, will be sold as a result of bankruptcy of the owner. Apparently a couple of north suburban residents were holding them in hopes of speculative gain, but amassed fines and back taxes such that the lots are now to be auctioned off.

The Tribune interviewed some potential bidders who hoped to build housing or commercial structures on the sites.

The article does not bother to mention that Cook County taxpayers provide at least two special benefits to owners of vacant lots. First, because there is no improvement on the lot, only the land value is taxed, whereas similar lots containing buildings would pay much more. And second, it is County policy to assess vacant land at only 10% of market value, whereas commercial and industrial uses would are assessed at 25% (unless granted special favors).

If Cook County omitted all improvements from assessments, and levied taxes based on land value only, a considerable tax burden would have been shifted to speculators from homeowners and others who productively use their land. And this bankruptcy sale, getting the land back into use, would have happened much sooner (or perhaps the owners would never have tried to speculate in land).