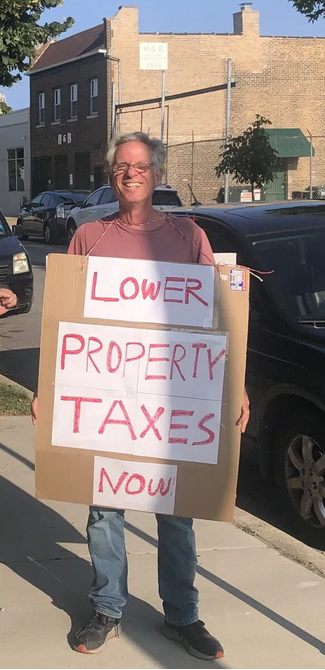

We have a Libertarian Party candidate for Cook County Assessor who apparently hasn’t learned the lessons of California’s Proposition 13. So he wants to do something similar here. Too late to do anything about that, I suppose, so this post is aimed at anyone thinking about running for Assessor in 2030.

The candidate proposes to “limit property taxes to 1% of assessed value with annual inflation increases capped at 2%.” In fact, the Assessor has no power to set property taxes, and is required to assess property at a predetermined percentage of his estimate of its market value. Changing that would require action from the State Legislature, and probably also the Cook County Board.

An Assessor candidate seeking tax reform might be successful with a different proposal: Simplify assessments by excluding all buildings and other improvements, taxing only the value of the land as vacant, and gradually increase the tax rate to eliminate the need for sales tax, income tax, and other prosperity-killing taxes. Of course this would also require cooperation from the State and County, but at least it would remove the burden on production, reducing the cost of living (including housing) and encouraging entrepreneurs who hire people to do useful things.

This 2030 Assessor candidate would need to improve the assessment of land value (assuming that the prior Assessor hasn’t done so) to realistically reflect what each site is worth. Then Cook County can move toward a true libertarian tax system. The Ultimate Tax Reform.