on this list? I like this shorter list better.

Of course, a serious highway reduction project requires competently-managed and properly-funded transit.

on this list? I like this shorter list better.

Of course, a serious highway reduction project requires competently-managed and properly-funded transit.

Now that we have the highest sales tax rates of any substantial community in the nation, it stands to reason that consumer prices, which include taxes, would be increasing faster here than nationally, right? Continue reading Chicago consumer prices lag

Chicago Dispatcher reports the median sales price of Chicago taxi medallions was $165,000 during the month ending March 23, up from $158,000 the previous month (and $77,000 in February 2007).

Last week, the Tribune published Cook County Assessor James Houlihan’s fiscal reform proposal. He wants to restructure the state sales tax and the state income tax, claiming that this would not only balance the state budget but also provide more funds to localities, theoretically allowing them to reduce real estate taxes.

But Mr. Assessor, how about the assessment and extension of real estate taxes. You know, the stuff you do? Can’t you improve that? Maybe you could start by assessing vacant land properly? And making sure that land value is fully included in all assessments? That’s not going to discourage any economic activity.

Then maybe we could ask the solons of the Cook County Board to change the property classification system, assessing improvements at only 40% of the ratio applied to land value? They could do this under existing law. Maybe they could even exempt improvements entirely? And, while we’re asking the Illinois General Assembly to reform things, why not eliminate the sales and income taxes, by resurrecting the state sales tax?

Regular readers of this blog, and Henry George School students, know why this is a good idea. Evidently Assessor Houlihan doesn’t want us to even think about it.

Wikipedia (right now) defines “earmark” as

a congressional provision that directs approved funds to be spent on specific projects or that directs specific exemptions from taxes or mandated fees.

On the face of it, I don’t see that as such a bad thing. If my Congressbeing has determined that the national interest requires a particular expenditure, it seems reasonable that she might want to make sure that a budget or appropriation item really will be used for that purpose.

The problem, of course, has been that earmarks are obscure, and invariably are for local projects in which the Federal government has no legitimate role. Now, the earmarks are being disclosed, at least by House members, and our friends at Taxpayers for Common Sense have compiled a list. Not of earmarks, but of URL’s where earmarks can be found.

I figured they might be bad, and they are. “My” Congressbeing, for instance, has a list of mainly municipal and nonprofit projects, at least some of which are economically justified and therefore should be funded out of the savings or other benefits which they produce. There are also a few government contractors being taken care of, and a couple of CTA projects. Because the latter is something I know a little bit about, I can say that the descriptions are quite deceptive, greatly exaggerating the result (e.g. “extension of the Yellow Line”) which will be obtained by a relatively modest ($1 million) expenditure.

And that list is hardly the worst.

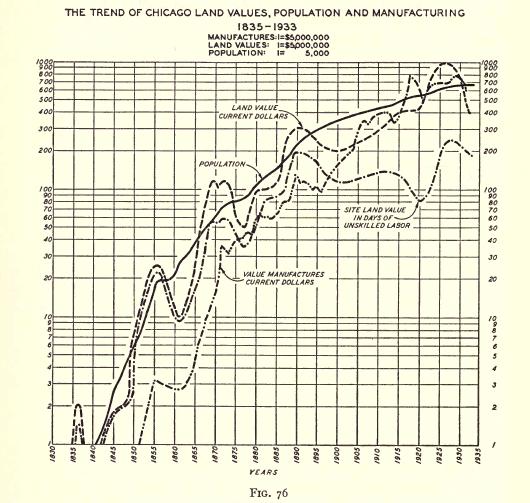

Homer Hoyt’s 1933 book “100 Years of Land value in Chicago” is now posted at the Internet Archive. Only a few land value nerds will read it all the way thru, but all should be impressed by the quantity of work Hoyt put into it, describing and analyzing Chicago’s land market for its first century.

This was all done before cheap photocopiers, faxes, and of course computers. I wish someone would update it.

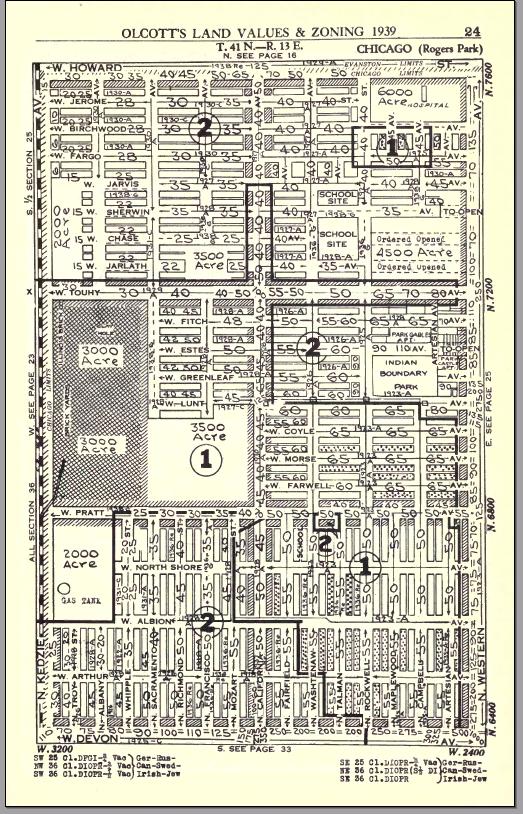

One of the challenges for many beginning Henry George School students is to understand that land has value, and that the value of land is really not very difficult to determine. One example that we used to use was Olcott’s Land Values Blue Book, an annual publication that, until the early ’90s, reported the estimated land value for every block in Chicago and much of suburban Cook County. I don’t know exactly why the series was discontinued, but I assume it was because professionals now find the Internet a more convenient source of information.

The 1939 edition of Olcott’s has been scanned and posted to the Internet Archive. Below is an example page.

The numbers in most areas are value per front foot for a standard-sized lot. The book includes adjustment factors for use where lots are other than standard. For unsubdivided parcels, a value per acre is shown.

Not me, that’s for sure. I’ve no doubt that command-and-control advocates would have trouble finding a better excuse to tell everyone what to do than to promise us that, if we don’t cooperate, we’ll all be flooded, starve to death, and die of thirst. Yet, maybe there is something to it. Continue reading Who understands global climate change?

Back in April, the median price for Chicago taxi medallions was $125,000. While almost every kind of “real estate” has continued crashing since then, medallions now (December 2008) have reached a median price of $155,000. Chicago Dispatcher says they get their data from the City of Chicago, but I haven’t found it on the City’s web site. Curiously, the only medallion listed on cabmarket.com is priced at just $139,000, and has lingered unsold for 54 days.

Real estate developer Jimmy Gierczyk spent $1.5 million to build a New Buffalo station for Amtrak. It’s adjacent to his real estate development. The source article doesn’t give a lot of detail about the project, but notes that he can now more easily market his condos to Chicagoans. Who are accustomed to paying much higher prices than folks in New Buffalo, I’d guess.

All of which raises the question, why can’t Amtrak collect more of the location value it generates or preserves?